DESK

Sep 23, 2011

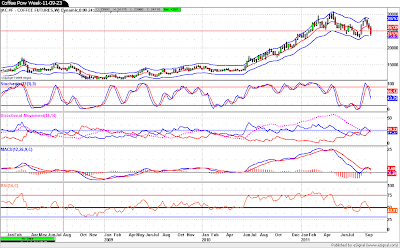

Coffee update Sept 23rd 2011, Moisture comes gradually .Frost risk vanishes suddenly!! Can this be named "volatility"?

As expected the (Head & Shoulders) graphical pattern was formed!

The odds to confirm that were helped by premature, misinformed weather speculators, associated with naïf expectations about easy money. Fear has avenged the greedy. Now time has come to help rational traders.

Don’t buy against the down trend, neither sell at weekly support! Stay out for now !!!

Sell rallies close to the bearish gap @ 251 and buy dips (with a tight stop) close to 235 (KCZ1) for short term.

So far the easiest direction to this mkt is down!!!! But rains haven´t come yet , but they should be coming !

If weather patterns does not fool us , the path of least support points towards a test of 175 objective!!

Strong Us dollar and a fair (off year crop harvest in Brazil) will help this , and give investors a good long term buying point!!!

The odds to confirm that were helped by premature, misinformed weather speculators, associated with naïf expectations about easy money. Fear has avenged the greedy. Now time has come to help rational traders.

Don’t buy against the down trend, neither sell at weekly support! Stay out for now !!!

Sell rallies close to the bearish gap @ 251 and buy dips (with a tight stop) close to 235 (KCZ1) for short term.

So far the easiest direction to this mkt is down!!!! But rains haven´t come yet , but they should be coming !

If weather patterns does not fool us , the path of least support points towards a test of 175 objective!!

Strong Us dollar and a fair (off year crop harvest in Brazil) will help this , and give investors a good long term buying point!!!

Sep 12, 2011

US $ dollar index 09/12/2011.Are we starting a long term upside reversal??

Where can you invest your assets nowadays??

1-)If you want to put it in the most stable (in US dollar terms) , supposedly solid , fundamentally reliable , although valued with a political bias , you should first of all , discover where to find the willingly, liquid and “reliable” sellers to sell what you want to buy , also defy their mood and intentions to sell it to you. Despite possibly being this task an impossible intention ,because totalitarian states don’t allow ,nor encourage competitors to threaten their politically controlled central banks intentions and goals that allow them to define the nominal quotations of their national currency.

So don’t loose your energy and talent in trying to build big long positions in Chinese Yuan currency.

2-)If Swiss bankers are not anymore concerned in guaranteeing your financial assets property ,and are becoming each day more pressured to cooperate with the effort of the Swiss central bank to defend the overvaluation of their currency and are unashamed in charging negative interest rates in an over valuated currency .

So, don’t loose your dignity and good mood in buying expensive Swiss Francs to store in a Swiss Bank safe box.

3)-If you had a chance to have , at least, high school education and you have attended the essential math class , you will not fell comfortable in putting your "nest eggs" in a country currency with a national sovereign debt somewhere around 200% of its GDP.

So, only invest in yens if you want to visit your banker in Japan to mourn the last Tsunami victims, may be you can get an earthquake experience as a bonus!

4-)If you are a good money manager , you should be loaded with commodities exporting dependent "emerging countries" currencies , all over valuated !

So , follow your text books and don’t add risk to a winning , although each day more risky position.

5-)If you like the color and the shinning of gold but feel uncomfortable for having lost the last ,long and wild, uptrend , still keep admiring the shine of the metal , but don’t buy a heavy gold collar neither a container of gold bars at the recent prices , simply because gold prices are priced in US dollars and when dollar currency is threatened , although not yet discredited , as a global exchange reference for commercial trades , the nominal price of gold go inversely up. And last but not least , remember that "strong currencies reserves” means GOLD in USA central bank. Remember the word "Fort Knox" ???? 9.000 MT of gold are stored there just for fun ......worth at current gold prices 1/4 to 1/3 of USA sovereign debt and roughly a bit less than the sum of all European countries gold reserves , 10 times China reserves , 8 times Russian reserves.

So, from now on , buy diamonds instead of gold to your wife /girlfriend.

6-)If you don’t want to help anticipate the real state asset bubble burst in strong currency , commodities exporting dependent emerging markets , you will not invest in a real state property just to have a distant Holliday vacation house , airline tickets are cheap and luxury hotels are kind off priced in London values, temporarily , because of local currency overvaluations.

So, don’t invest in a future headache possibility.

BOTTON LINE : The long , aged and unquestionable US dollar bear market seen to have reached its final and definitive bottom!

SO START BUYING DOLLAR CURRENCY AND KEEP IT ANYWHERE OTHER THEN US SOVEREING DEBT. IF YOU ARE FINANCIALLY AGRESSIVE YOU COULD EVEN INVEST YOUR DOLLARS IN AMERICAN REAL STATE PROPERTIES AND ,WHY NOT, IN INFRAESTRUCTURE RELATED COMPANIES STOCKS.

After important support being tested , strong upside reversal . Ma´s much easier to be broken this time!

After a strong upside reversal , resistances are ahead , but the strong ones are already behind!

Seens very though task for Gold be more valuable when priced in Crude oil prices!

The best and more consistent trend in last 30 years , the nest of the crises! Now supported by Uncle Sam . If and when it bursts , the US dollar will jump the bumps wildely.

VIX are nervous , but still under control , no risk avertion situations in near sight.

1-)If you want to put it in the most stable (in US dollar terms) , supposedly solid , fundamentally reliable , although valued with a political bias , you should first of all , discover where to find the willingly, liquid and “reliable” sellers to sell what you want to buy , also defy their mood and intentions to sell it to you. Despite possibly being this task an impossible intention ,because totalitarian states don’t allow ,nor encourage competitors to threaten their politically controlled central banks intentions and goals that allow them to define the nominal quotations of their national currency.

So don’t loose your energy and talent in trying to build big long positions in Chinese Yuan currency.

2-)If Swiss bankers are not anymore concerned in guaranteeing your financial assets property ,and are becoming each day more pressured to cooperate with the effort of the Swiss central bank to defend the overvaluation of their currency and are unashamed in charging negative interest rates in an over valuated currency .

So, don’t loose your dignity and good mood in buying expensive Swiss Francs to store in a Swiss Bank safe box.

3)-If you had a chance to have , at least, high school education and you have attended the essential math class , you will not fell comfortable in putting your "nest eggs" in a country currency with a national sovereign debt somewhere around 200% of its GDP.

So, only invest in yens if you want to visit your banker in Japan to mourn the last Tsunami victims, may be you can get an earthquake experience as a bonus!

4-)If you are a good money manager , you should be loaded with commodities exporting dependent "emerging countries" currencies , all over valuated !

So , follow your text books and don’t add risk to a winning , although each day more risky position.

5-)If you like the color and the shinning of gold but feel uncomfortable for having lost the last ,long and wild, uptrend , still keep admiring the shine of the metal , but don’t buy a heavy gold collar neither a container of gold bars at the recent prices , simply because gold prices are priced in US dollars and when dollar currency is threatened , although not yet discredited , as a global exchange reference for commercial trades , the nominal price of gold go inversely up. And last but not least , remember that "strong currencies reserves” means GOLD in USA central bank. Remember the word "Fort Knox" ???? 9.000 MT of gold are stored there just for fun ......worth at current gold prices 1/4 to 1/3 of USA sovereign debt and roughly a bit less than the sum of all European countries gold reserves , 10 times China reserves , 8 times Russian reserves.

So, from now on , buy diamonds instead of gold to your wife /girlfriend.

6-)If you don’t want to help anticipate the real state asset bubble burst in strong currency , commodities exporting dependent emerging markets , you will not invest in a real state property just to have a distant Holliday vacation house , airline tickets are cheap and luxury hotels are kind off priced in London values, temporarily , because of local currency overvaluations.

So, don’t invest in a future headache possibility.

BOTTON LINE : The long , aged and unquestionable US dollar bear market seen to have reached its final and definitive bottom!

SO START BUYING DOLLAR CURRENCY AND KEEP IT ANYWHERE OTHER THEN US SOVEREING DEBT. IF YOU ARE FINANCIALLY AGRESSIVE YOU COULD EVEN INVEST YOUR DOLLARS IN AMERICAN REAL STATE PROPERTIES AND ,WHY NOT, IN INFRAESTRUCTURE RELATED COMPANIES STOCKS.

After important support being tested , strong upside reversal . Ma´s much easier to be broken this time!

After a strong upside reversal , resistances are ahead , but the strong ones are already behind!

Stocks are very cheap historicaly , in relation to gold prices. This is not sustainable for much more time , since the world economy depends on the health of American economy!

Seens very though task for Gold be more valuable when priced in Crude oil prices!

The best and more consistent trend in last 30 years , the nest of the crises! Now supported by Uncle Sam . If and when it bursts , the US dollar will jump the bumps wildely.

VIX are nervous , but still under control , no risk avertion situations in near sight.

Sep 10, 2011

Coffee update Sept 10th 2011- Technical resistance action or expected moisture faith!

Frost happens in one morning , drought happens in one season! Coffee futures prices have technicaly reacted this week exactly as we expected according to text books lessons! Ancient strong supports , now strong resistances around 2.85/2.90 (now in KCZ1) were sufficient nought to stop and so far revert the , corrective , althought wild and fast upside move. We are talking here about a 60 cts move in 3 weeks with a 25 cts move on the opposite side in half a week.(translated in $$ , that means an up move worth U$ 24,000 per contract with a U$ 10,000 corrective move in 3 days , less than 3 weeks latter.

At least for unprepared coffee traders who still think that hedge is a magical and divine word , hell could has been saw as a possible reality this year.

At the end of this week , the market has clearly shown to the fools that much more expectation changes of future S&D will be needed to break the 3.00 barrier. Only a drought could do this , but it still is possible.

Till there (first week of october) , without a seasonal normalization of rain patterns , TECHNICALS will

rule price moves , as it has happened this week.

Bears , if any , shouldnt be too excited about this wild downside move , since the 2.65 support is very strong and will do its best to support the prices.

I would bet on a sideways trading range (2.65/2.75) for now .

But just have in the back of your mind : If just the annoucement of a few moistured clouds have imposed such a pain to the Bulls .....what could be prepared for them , when and if the very light first rains arrive as seasonally scheduled?????????????????

For now just be TECHNICAL!!!!!

At least for unprepared coffee traders who still think that hedge is a magical and divine word , hell could has been saw as a possible reality this year.

At the end of this week , the market has clearly shown to the fools that much more expectation changes of future S&D will be needed to break the 3.00 barrier. Only a drought could do this , but it still is possible.

Till there (first week of october) , without a seasonal normalization of rain patterns , TECHNICALS will

rule price moves , as it has happened this week.

Bears , if any , shouldnt be too excited about this wild downside move , since the 2.65 support is very strong and will do its best to support the prices.

I would bet on a sideways trading range (2.65/2.75) for now .

But just have in the back of your mind : If just the annoucement of a few moistured clouds have imposed such a pain to the Bulls .....what could be prepared for them , when and if the very light first rains arrive as seasonally scheduled?????????????????

For now just be TECHNICAL!!!!!

Sep 3, 2011

Coffee Update Sept 3rd 2011-After a cold winter , a possible dry spring?

September 3rd 2011,

After a complex downside correction , when coffee prices tested their forecasted technical and (why not fundamental) supports around 2.25 (1rst month kcu11) , as expected , coffee prices have shown its strongest possible reaction to the opposite site . The strenght of the upside move from 2.3530 to 2.9085 (kcz11) without any stop to breath , can only be explained by a mix of technical liquidation of short positions with agressive new speculative longs , possibly based on weather bets.

The usual deadline for rains to show up before we say that we are in a drought situation is the end of the first week of october. Untill there if rains show up at any moment , the spring flowering of the coffee trees could be surprisely strong .

CONCLUSION: As usual the mkt has given the fools its hidden surprises!

2.25 and 2.85 still is the "traders" "trading range" of this market!

Technicaly : We may be just forming a misleading bull trap in the form of a bearish head&shoulder , looking at the trend indicators and oscilators on the monthly charts (the only timely bars that we can look in the actual mkt situation ) , the mkt still is in a directional bull trend (ADX) , but to many divergences are showing up and i would prefer to bet on the strenght of the resistances being tested now , and not on the possibility of a new high.

From an Elliott wave perspective , we may just be forming a complex "Double Zig-Zag" correction of the recent bull market.

The KCZ11 August high @ 288.50 is very important to be respected on a closing basis , to allow new mkt highs. So far the first weekly close of KCZ11 in September was not able to sustain this level , closing @ 288.05

Fundamentaly:The weather patterns in general and also in the brazilian coffee regions , have been

so far unfriendly to coffee trees this year . If we dont have a good flowering , wich should occur soon and a very normal pattern of rains starting at the end of this month ; just tighten your seat belts and forget any technical or logical analisys of future coffee prices.

pls read SHOULDER

After a complex downside correction , when coffee prices tested their forecasted technical and (why not fundamental) supports around 2.25 (1rst month kcu11) , as expected , coffee prices have shown its strongest possible reaction to the opposite site . The strenght of the upside move from 2.3530 to 2.9085 (kcz11) without any stop to breath , can only be explained by a mix of technical liquidation of short positions with agressive new speculative longs , possibly based on weather bets.

The usual deadline for rains to show up before we say that we are in a drought situation is the end of the first week of october. Untill there if rains show up at any moment , the spring flowering of the coffee trees could be surprisely strong .

CONCLUSION: As usual the mkt has given the fools its hidden surprises!

2.25 and 2.85 still is the "traders" "trading range" of this market!

Technicaly : We may be just forming a misleading bull trap in the form of a bearish head&shoulder , looking at the trend indicators and oscilators on the monthly charts (the only timely bars that we can look in the actual mkt situation ) , the mkt still is in a directional bull trend (ADX) , but to many divergences are showing up and i would prefer to bet on the strenght of the resistances being tested now , and not on the possibility of a new high.

From an Elliott wave perspective , we may just be forming a complex "Double Zig-Zag" correction of the recent bull market.

The KCZ11 August high @ 288.50 is very important to be respected on a closing basis , to allow new mkt highs. So far the first weekly close of KCZ11 in September was not able to sustain this level , closing @ 288.05

Fundamentaly:The weather patterns in general and also in the brazilian coffee regions , have been

so far unfriendly to coffee trees this year . If we dont have a good flowering , wich should occur soon and a very normal pattern of rains starting at the end of this month ; just tighten your seat belts and forget any technical or logical analisys of future coffee prices.

pls read SHOULDER

Subscribe to:

Posts (Atom)

Despertador online - RelogioOnline.com.br

Defina a hora e os minutos no despertador online. A mensagem de alarme aparecerá e o som selecionado será reproduzido no momento escolhido. ...

-

Coffee Update: October 20, 2011 Elliott waves counting are becoming clearer, showing at each new chart bar , that we may just be in...