Power Track Futures

POWER TRACK

DESK

Nov 13, 2023

Jul 14, 2023

#SILVER #SI #bull #buy #akkap #akkapp #blogspot #markets #comex #futures #commodities #trader #trading

SILVER SI #F 2023-07-13 "More than enough room for more upside gains on weekly basis " No pain no gains , risk /reward situation for deep pockets . Avoid any kind of leveraged positions , since tight stops not possible here. Just put "buying mode"

Feb 21, 2022

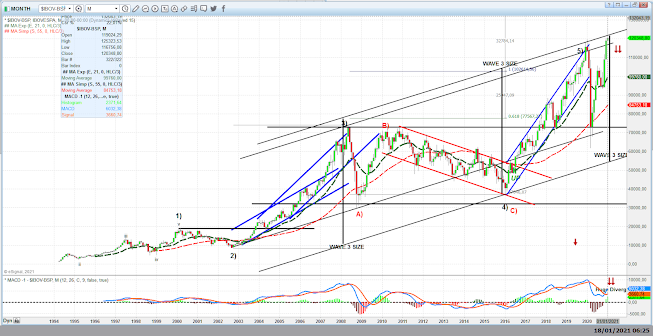

SILVER SI1! . Bullish Elliott Wave long term analysis .Published 2022/02/22 at 06:3 0am . UPDATE TOMOROW 2023/05/06.

SILVER SI1!

Bullish Elliott Wave long term analysis

Published 2022/02/22 at 06:3 0am

SILVER SI 1!

A perfect EWcount for the start of a long term bullish W 3,3,3

All Macd´s cross were for wave 1 end and the beginning of a wave 2.

All waves 1 were either 0,382 or 0,618 of the 5 waves formed to complete the wave 1 of next degree.

The charts speaks for itself!!!

good luck!

Bullish Elliott Wave long term analysis

Published 2022/02/22 at 06:3 0am

SILVER SI 1!

A perfect EWcount for the start of a long term bullish W 3,3,3

All Macd´s cross were for wave 1 end and the beginning of a wave 2.

All waves 1 were either 0,382 or 0,618 of the 5 waves formed to complete the wave 1 of next degree.

The charts speaks for itself!!!

good luck!

Jan 23, 2022

Jan 9, 2022

Dec 28, 2021

Dec 25, 2021

DX #F Dollar Index Monthly 1979-2021 , my Elliott wave analisys . A case for a prompt resolution to lower levels !

On the weekly DX chart we can clearly perceive a "Cluster" of strong Fibonacci and Elliott theory based resistances @ 96.00 to 97.00 , that makes a barrier impede higher levels now in the DOLLAR INDEX

Mar 9, 2021

Feb 13, 2020

Dec 4, 2014

JUST REMEMBERING!!!! Sep 12, 2011 US $ dollar index 09/12/2011.Are we starting a long term upside reversal??

Where can you invest your assets nowadays??

1-)If you want to invest in assets which have low volatility and low risk quality (in US dollar terms), , even if priced on a valued political bias , you should first discover where to find the sellers to sell what you want to buy , also defy their mood and intentions to sell it to you. Even if this task looks like an almost impossible deal , because central banks doesn't like competition to bother their power to define the nominal quotations of their national currency.

So don’t loose your energy and talent in trying to build big long positions in Chinese Yuan currency.

2-)If Swiss bankers are not anymore focused in guaranteeing your financial assets safety anonymity ,and are day after day more pressured to cooperate with the effort of the Swiss central bank to defend the overvaluation of their currency and are unashamed in charging negative interest rates in an over valuated currency .

Don’t loose your dignity and good mood in buying expensive Swiss Francs to store in a Swiss Bank safe box.

3)-If you had a chance to have , at least, high school education and you have attended the essential math class , you will not fell comfortable in investing your savings in a currency of a nation with a national sovereign debt somewhere around 200% of its GDP.

So, if you want to pay a visit to your kind japanese banker , just pass by to have a coffee , when attending the next hotest robotics convention fair . Be carefull , during your free time you can have na earthquake experience as a bonus!

4-)If you are a trend following trader , you may be loaded with commodities exporting dependent "emerging countries" currencies , all over valuated !

So , follow your text books and don’t add risk to a winning but already pricey and risky long position. Throw all longs away , and turn short on those currencies!

5-)If you like the color and the shinning of gold but feel uncomfortable for having lost the last ,long and wild, uptrend , still keep admiring the shine of the metal , KEEP CALM AND BUY A HEAVY GOLD NECKLKE but not a container of GOLD, simply because gold prices are priced in US dollars and when dollar currency is threatened , although not yet discredited , as a global exchange reference for commercial trades , the nominal price of gold go inversely up. And last but not least , remember that "strong currencies reserves” means GOLD in USA central bank. Remember the word "Fort Knox" ???? 9.000 MT of gold are stored there just for fun ......worth at current gold prices 1/4 to 1/3 of USA sovereign debt and roughly a bit less than the sum of all European countries gold reserves , 10 times China reserves , 8 times Russian reserves.

So, from now on , buy diamonds instead of gold to your wife /girlfriend even if it is just to avoid taxes...lol

6-)If you don’t want to help anticipate the real state asset bubble burst in overvalued BRICS , which are the most commodities exporting dependent emerging markets , stay away of a real state property there you will realize that you would be just being seduced buy the luxury and frivolity of possessing a distant Holliday vacation house , airline tickets are cheap and luxury hotels are fair priced .

So, don’t invest in a future headache possibility.

BOTTON LINE : The long , aged and unquestionable US dollar bear market seen to have reached its final and definitive bottom!

SO START BUYING DOLLAR CURRENCY AND KEEP IT ANYWHERE OTHER THEN US SOVEREING DEBT. IF YOU ARE FINANCIALLY AGRESSIVE YOU COULD EVEN INVEST YOUR DOLLARS IN AMERICAN REAL STATE PROPERTIES AND ,WHY NOT, IN INFRAESTRUCTURE RELATED COMPANIES STOCKS.

After important support being tested , strong upside reversal . Ma´s much easier to be broken this time!

After a strong upside reversal , resistances are ahead , but the strong ones are already behind!

Stocks are very cheap historicaly , in relation to gold prices. This is not sustainable for much more time , since the world economy depends on the health of American economy!

Seens very though task for Gold be more valuable when priced in Crude oil prices!

The best and more consistent trend in last 30 years , the nest of the crises! Now supported by Uncle Sam . If and when it bursts , the US dollar will jump the bumps wildely.

VIX are nervous , but still under control , no risk avertion situations in near sight.

1-)If you want to invest in assets which have low volatility and low risk quality (in US dollar terms), , even if priced on a valued political bias , you should first discover where to find the sellers to sell what you want to buy , also defy their mood and intentions to sell it to you. Even if this task looks like an almost impossible deal , because central banks doesn't like competition to bother their power to define the nominal quotations of their national currency.

So don’t loose your energy and talent in trying to build big long positions in Chinese Yuan currency.

2-)If Swiss bankers are not anymore focused in guaranteeing your financial assets safety anonymity ,and are day after day more pressured to cooperate with the effort of the Swiss central bank to defend the overvaluation of their currency and are unashamed in charging negative interest rates in an over valuated currency .

Don’t loose your dignity and good mood in buying expensive Swiss Francs to store in a Swiss Bank safe box.

3)-If you had a chance to have , at least, high school education and you have attended the essential math class , you will not fell comfortable in investing your savings in a currency of a nation with a national sovereign debt somewhere around 200% of its GDP.

So, if you want to pay a visit to your kind japanese banker , just pass by to have a coffee , when attending the next hotest robotics convention fair . Be carefull , during your free time you can have na earthquake experience as a bonus!

4-)If you are a trend following trader , you may be loaded with commodities exporting dependent "emerging countries" currencies , all over valuated !

So , follow your text books and don’t add risk to a winning but already pricey and risky long position. Throw all longs away , and turn short on those currencies!

5-)If you like the color and the shinning of gold but feel uncomfortable for having lost the last ,long and wild, uptrend , still keep admiring the shine of the metal , KEEP CALM AND BUY A HEAVY GOLD NECKLKE but not a container of GOLD, simply because gold prices are priced in US dollars and when dollar currency is threatened , although not yet discredited , as a global exchange reference for commercial trades , the nominal price of gold go inversely up. And last but not least , remember that "strong currencies reserves” means GOLD in USA central bank. Remember the word "Fort Knox" ???? 9.000 MT of gold are stored there just for fun ......worth at current gold prices 1/4 to 1/3 of USA sovereign debt and roughly a bit less than the sum of all European countries gold reserves , 10 times China reserves , 8 times Russian reserves.

So, from now on , buy diamonds instead of gold to your wife /girlfriend even if it is just to avoid taxes...lol

6-)If you don’t want to help anticipate the real state asset bubble burst in overvalued BRICS , which are the most commodities exporting dependent emerging markets , stay away of a real state property there you will realize that you would be just being seduced buy the luxury and frivolity of possessing a distant Holliday vacation house , airline tickets are cheap and luxury hotels are fair priced .

So, don’t invest in a future headache possibility.

BOTTON LINE : The long , aged and unquestionable US dollar bear market seen to have reached its final and definitive bottom!

SO START BUYING DOLLAR CURRENCY AND KEEP IT ANYWHERE OTHER THEN US SOVEREING DEBT. IF YOU ARE FINANCIALLY AGRESSIVE YOU COULD EVEN INVEST YOUR DOLLARS IN AMERICAN REAL STATE PROPERTIES AND ,WHY NOT, IN INFRAESTRUCTURE RELATED COMPANIES STOCKS.

After important support being tested , strong upside reversal . Ma´s much easier to be broken this time!

After a strong upside reversal , resistances are ahead , but the strong ones are already behind!

Stocks are very cheap historicaly , in relation to gold prices. This is not sustainable for much more time , since the world economy depends on the health of American economy!

Seens very though task for Gold be more valuable when priced in Crude oil prices!

The best and more consistent trend in last 30 years , the nest of the crises! Now supported by Uncle Sam . If and when it bursts , the US dollar will jump the bumps wildely.

VIX are nervous , but still under control , no risk avertion situations in near sight.

Nov 11, 2012

Jan 12, 2012

Coffee Update , Jan 12th 2012. Buying signals starting to show up in coffee.

Coffee futures prices may have posted a short, if not a medium term bottom!

After failing to post a convincingly close under 2.20 , a very strong technical and psychological support , prices have rebounded quickly and sharply almost 25 cts , breaking all overhead resistances . Downtrend lines and short and long ma´s resistances were also left behind on a move with good volume and increasing OI , showing that new longs are challenging recently added new shorts who sold short at market bottom.

A close over 2,38 (dec 2011 high) will start to scare the weakest bears , a close over 2,42 (2010 high) will make must of them cover shorts , possibly pushing prices on a quickly run to 2,50/2,55 , where fundamentals will impose next price move.

All graphical lines and technical indicators or oscillators supports this short term scenario.

Rgds

Alvaro

After failing to post a convincingly close under 2.20 , a very strong technical and psychological support , prices have rebounded quickly and sharply almost 25 cts , breaking all overhead resistances . Downtrend lines and short and long ma´s resistances were also left behind on a move with good volume and increasing OI , showing that new longs are challenging recently added new shorts who sold short at market bottom.

A close over 2,38 (dec 2011 high) will start to scare the weakest bears , a close over 2,42 (2010 high) will make must of them cover shorts , possibly pushing prices on a quickly run to 2,50/2,55 , where fundamentals will impose next price move.

All graphical lines and technical indicators or oscillators supports this short term scenario.

Rgds

Alvaro

Subscribe to:

Comments (Atom)

-

Where can you invest your assets nowadays?? 1-)If you want to invest in assets which have low volatility and low risk quality (in US dollar...